Remember the 90’s

Remember when 1p sweets were 1p and Petrol was .45p a litre and Blockbuster was still around. For millennials, these were the good old days filled with nostalgic memories of a simpler time playing on the Nintendo 64 or watching MTV when it was raining on your school summer holidays. Jurassic Park was in the cinema making dinosaurs real and the pre-internet world was a lot simpler and quieter.

Remember when McDonalds happy meals were a proper meal and Pizza hut was a big night out with the family. All of these wholesome activities have been replaced with that screen in your pocket that you stare at for 8 hours a day.

Technology is deflationary force. It strives to makes everything cheaper. That phone in your pocket has replaced the calculator, the satnav, your home computer and your downtime. Where once we ‘socialised’ with our friends and family, we now scroll past their carefully doctored selfies and hate them just a little bit for living a perfect life.

Going forward we will see people even less as our social needs are met in the metaverse. It won’t all be bad though. We can’t wait to slay a Monster with our friends for example but we will miss the physical nearness of that connection. Those ties that bind us will be diluted as our social net increases in size. Gone are the days where we knew only the people in our village. The world has truly become a global village where anyone anywhere can be accessed within moments courtesy of the technology at out finger tips.

With technology continuously striving to make things cheaper… why then have the costs of the basics commodities increased so much?

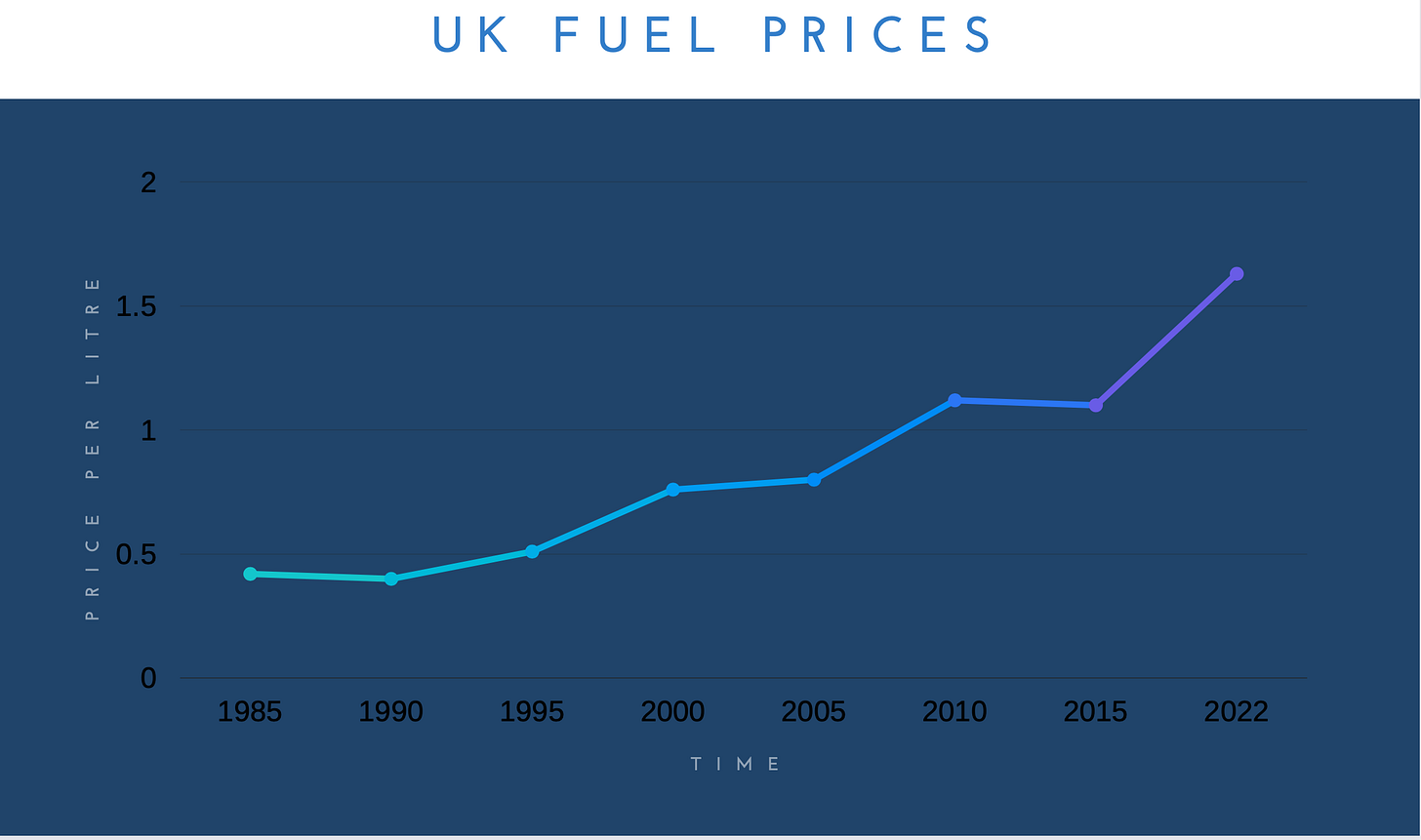

Why has petrol gone from £0.45 in the 90’s to £1.63 today? It is the EXACT same product and with technology it is cheaper to get out of the ground….

Even before the Ukraine crisis petrol was significantly dearer. It’s not just taxes, or green initiatives driving up the price. Our currency has lost its value!

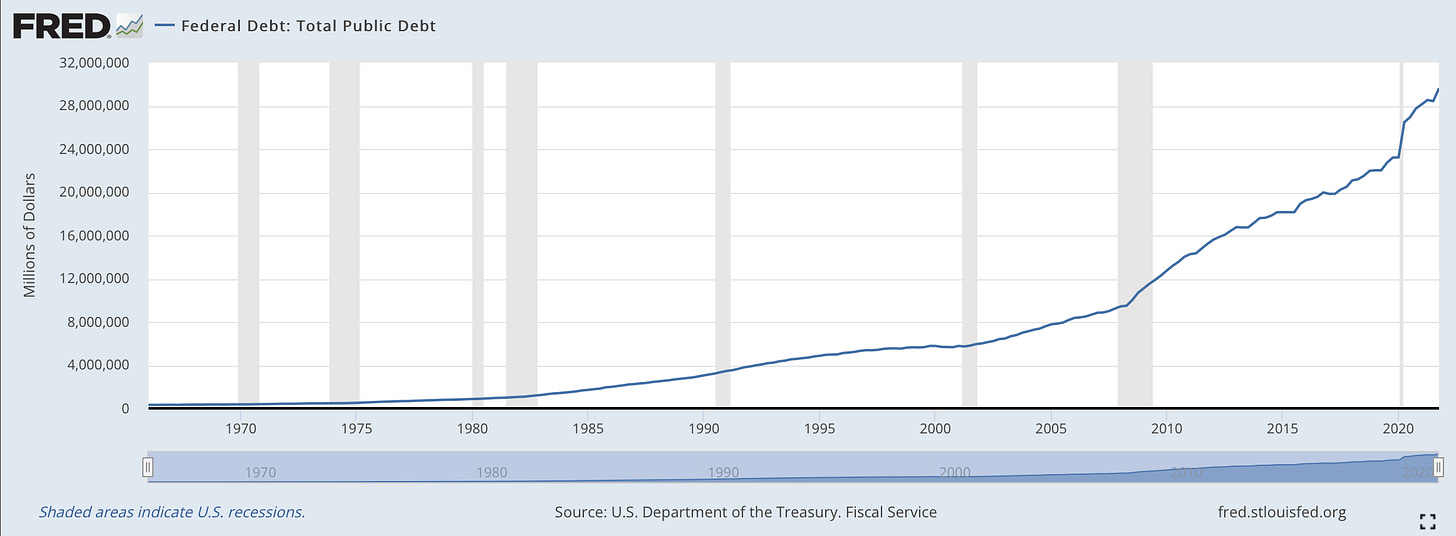

Our currency, whether that is the US Dollar or the Great British Pound is designed to lose value over time. The Federal Reserve & The Bank of England can magic money out of thin air with the click of a button.

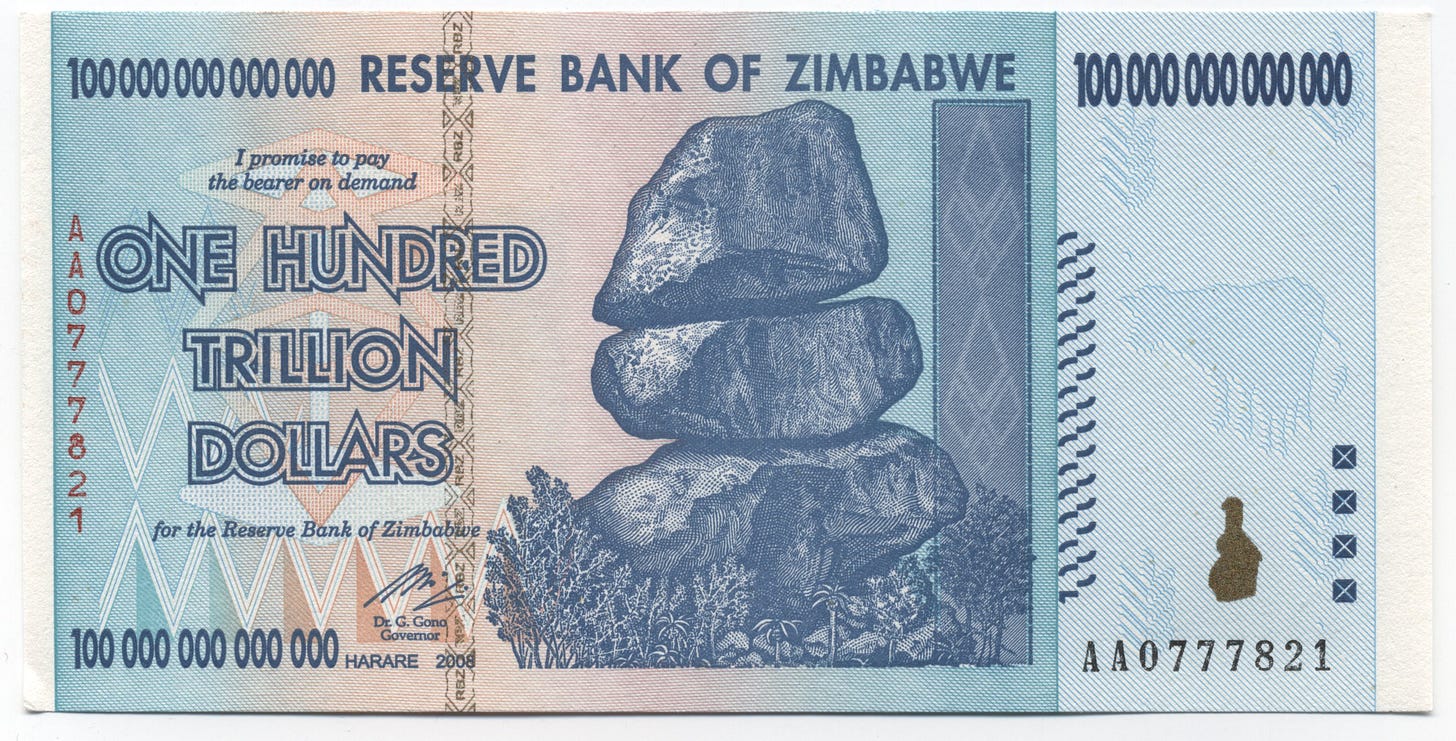

Being able to magic money out of thin air is a serious problem. Governments can print money to cover any cash flow shortages and this would largely not cause any problems as long as the money is repaid. Which it never is or can ever be (mathematically impossible now)

If a government needs more money than it can raise through taxes it can borrow the money from its central bank. The central bank prints the money (diluting the total supply) which the government then spends. Later, the government “repays” the central bank and the central bank could destroy that burned money. That would be a safe and sensible policy to let a currency retain its value.

Governments have not done that. They have borrowed increasingly large amounts of money to spend on whatever political fancies are popular that day. They have to repay those debts over time but what they have done is borrowed more money to pay off current debts. It’s possible to live this way in the short term, borrowing money from the future to pay debts today but everyone knows it will inevitably end in disasters and that is what is starting to happen now.

Governments (especially the US) have borrowed so much money and diluted the value of their money to such a degree that prices are soaring. People (and nations) who hold their wealth in dollars have seen that wealth drop as the money printer’s print.

It’s not just individuals that are suffering. The governments have been lending this money they have printed out to companies in order to keep them open. These companies found themselves flush with cheap money and naturally put it to work. Some of them made good investments while many did not. Many chose to buy their own shares from the market which reduced the amount of shares in circulation and increased the share price (very popular with shareholders). Not many chose to invest in the future.

So, what happens to these companies that used the cheap money to buy their own shares when they have to pay back the money they borrowed? They have to sell the shares of course. This will lead to lots of shares being dumped on the market and share prices falling (sad shareholders). They could possibly keep the shares but if they do, they still have to pay the interest on the money they borrowed. If the central banks increase the interest rates then that becomes more expensive and squeezes those companies.

So as a company director what can you do? secure your bonus for the year and jump ship of course. We wonder how many times that will happen in the next few years.

We miss the 90’s when the system was still pretending to work before the rampant excessive borrowing went vertical.

The piper will come to call one day and for most the idea of acquiring large amounts of Hard Money Assets (Gold, Silver, Art, Property) is untenable, however you can allocate to the hardest asset in the known universe : Bitcoin.

Take it easy readers… if you do then take it twice!

The Wealth Gap