What is it?

KEY TAKEAWAYS (investopedia)

A crack-up boom is the crash of the credit and monetary system due to continual credit expansion (money printing) and price increases that cannot be sustained long-term.

In the face of excessive credit expansion, consumers' inflation expectations accelerate to the point that money becomes worthless and the economic system crashes.

The term was coined by Ludwig von Mises, a noted member of the Austrian School of Economics and personal witness to the damages of hyperinflation.

The crack-up boom develops out of the same process of credit expansion and the resulting distortion of the economy that occurs during the normal boom phase of Austrian business cycle theory.

In the crack-up boom, the central bank attempts to sustain the boom indefinitely without regard to consequences, such as inflation and asset price bubbles. The problem comes when the government continuously pours more and more money into the economy to give it a short-term boost after short term boost. This eventually triggers a fundamental breakdown in the economy.

Have you noticed prices going up since March 2020? This was when the global economy for the first time in human history came to a halt courtesy of “Covid”.

Odd isn’t it, we faced the worst economic conditions ever and yet stocks rallied, house values shot up stupidly and today we are seeing every day goods get real expensive real fast…

In their efforts to prevent any downturn in the economy, monetary authorities continue to expand the supply of money and credit at an accelerating pace and will avoid turning off the taps of money supply until it is too late. Que March 2020 onwards.

In the normal course of an economic boom (driven by the expansion of money and credit) the structure of the economy becomes distorted in ways that eventually result in shortages of various commodities and types of labor, which then lead to increased consumer price inflation.

Nah that won’t happen… will it…👇🏼

So what happens next?

No one can predict the future and the uncertainty generates enough terror that there is high demand for ‘experts’ to tell us what is going to happen. It doesn’t matter if we are told 1+1=3 by these “experts” because there is only ever one solution, print now and worry about it later. We know this is true because Treasuries and Central banks of the G7 nations keep confirming it to us through their actions.

Rising prices, limited availability of necessary inputs and limited labor has led to huge pressures on businesses. This “should” cause a rash of failures of various investment projects and business bankruptcies. With massive bouts of money printing, central bank planning can prevent these failure over the short term. The downside is that we are left with “zombie” companies that should by all rights be dead and bankrupt but are kept alive by continued borrowing. Think Airlines 2020 or Banks 2008 with the word “bailout” or “too big to fail”. If a company is described as ‘too big to fail’ its a zombie company.

In the end however there will come a real resource crunch, which triggers the turning point in the economy from boom to bust. You can’t fake resources and commodities like you can Debt, Stocks and Financial Magic.

If you need Oil, Gas, Iron, Pot Ash, Fertiliser, Nickel, Silver, Wheat, Meat and it is not available in the required quantities, if at all…well the writing starts to appear on the wall. You can’t magic these things out of thin air like you can “currency” when the demand for “Things” over “Paper money stuff” becomes really real, real fast!

So what happens next FFS?

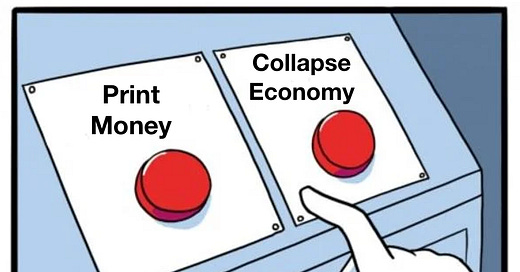

As this crisis point approaches, the central bank has a choice: either to accelerate the expansion of the money supply in order to try to help businesses pay for the increasing prices and wages they are faced with and delay the recession, or to refrain from doing so at the risk of allowing some businesses to fail, asset prices to fall, and disinflation (and possibly a recession or depression) to occur.

The crack-up boom occurs when the central bank chooses and sticks with the first option.

Once the central bank decides to accelerate the process of credit expansion and inflation in order to head off any recession risk, then it continually faces the same choice of either accelerating the process further or facing an even greater risk of recession as distortions building in the real economy.

Thus they are in a doomed if they do, doomed faster if they don’t … a shit circle jerk of monumental dogshit outcomes.

We don’t blame the current central bankers, they have no choice here, these problems were set way back before their time in office. In 1913 the Federal Reserve System (FED) was created, in 1944 Bretton Wood agreement stupidly pegged the world to the dollar and then in 1971 the US Dollar was unpegged from gold.

TLDR - What is Going to Happen

It is more than likely that we will see a short-term pullback in the US markets in response to the “rate hikes” the FED is threatening. This won’t last as the FED cannot increase interest rates to previous “norms” without destroying and bankrupting the US economy. So, they start a process of small raises, the stocks crash and around -20% off the highs they will fucking panic and step in with Emergency Printing likely with a title to justify like “Printing more to fight Putin” or words to that affect. Keep an eye out for that one, don’t worry we will remind you when it comes 😎

Then we should see a monumental rally in broad risk equities, commodity stocks and crypto as a whole. The “rapid rise” is the crack up boom and then … well its anybody’s guess how long that lasts as that depends on the political demand not to be in the driving seat when this thing crashes.

Remember the 1920’s in NYC with the “Roaring” element. Soon after the Roar came the Great Depression… some can argue that the only reason the US and the Dollar currency survived that period is because it was pegged as the reserve currency for the rest of the world.

How did America get out of this mess from 1932 onwards… well WW2 and the drive from Europe for raw material “things” from America.

We will leave you with this thought:

What is the Value of a dollar if they keep creating it with no cost?

Till Next Time

The Wealth Gap Team