Bearish Trend Break-Out

Looking below at the daily chart of Bitcoin you can clearly see the recent price activity has pushed the structure out of the bearish channel (downwards red box) and now testing higher resistance levels at 40-45k range.

The Wealth Gap View : If market structure holds and we do not get bearish news out of the congress hearings on the infrastructure bill then we are looking strong here on a technical analysis. Next step is to retest support in the 40k range then a rapid move back up to the 60k region finding the next level of resistance.

BSV just suffered a 51% attack

To run Blockchains you need a decentralised network of computers (miners or nodes) Transactions are approved by this network and entered into the blockchain. A 51% attack is when more than 51% of the miners team up to control the whole network. By doing this an attacker can stop transactions, rewrite previous transactions and even double spend the blockchains currency.

This just happened to Bitcoin Satoshi Vision (BSV). THIS IS NOT BITCOIN (BTC).

What is BSV?

BSV is a fork, or splinter currency, of Bitcoin Cash (itself a fork/splinter of Bitcoin) During the 2017 bull run BTC was struggling to complete all the transactions on the network. This is called the scaling problem. BSV forked from Bitcoin Cash to try address this issue. The creators fought a hard PR campaign to convince everyone that BSV was the one true bitcoin but no one agreed.

Can a 51% attack happen to Bitcoin?

Theoretically yes but at this stage it would be hugely expensive to try and it’s more profitable to mine honestly so the financial incentives aren’t there. A fork could always be an option as well but undesirable unless a worst case scenario comes to fruition.

The Wealth Gap View: We always try to maintain that Bitcoin is a monetary network aiming to store and transfer value, as such is the King in this field. All other coins may play a role in this landscape but come with massive inherent risk. We see them more as a trade (buy and sell for gains) over being an instrument for savings and long term growth.

Ray Dalio (72 yr old billionaire hedge fund manager) Likes Bitcoin

The Wealth Gap View: Ray is a thought leader and people listen to him. He has slowly been moving towards a pro Bitcoin view for years now. We think its only a matter of time before he comes around. He is limited in what he can publicly say but we believe that he is vested in Bitcoin and can see the writing on the wall with the Bond and Fixed income market. Notably he recently said:

“The more we create savings in [Bitcoin], the more you might say, ‘I'd rather have Bitcoin than the bond.’ Personally, I'd rather have Bitcoin than a bond."

Only a matter of time in our opinion before the bond market and fixed income buyers start to diversify into BTC 😎

Uruguay Senator introduced a bill to make Bitcoin a legal Tender

Senator Juan Sartori has introduced a bill to make Bitcoin legal tender. He follows in the footsteps of El Salvador who made it legal in June. Other countries lining up are as follows:

Paraguay

Panama

Mexico

Venezuela

Possibly Naicaragua, Argentina & Malta as well

Why..?

These countries rely on remittance payments and transferring money via the SWIFT (traditional route) is expensive. Crypto allows the easy and cheap transfer of money across borders.

Venezuela should be one of the richest countries in the world but has done a terrible job harnessing it. The nations currency (Bolivar) has suffered from appalling hyperinflation for years and they have recently tried to role out their own cryptocurrency which has also been a dissappointment. Making Bitcoin legal tender could go some way to improving the lives of Venezuelans who have been using Bitcoin for years already.

The Wealth Gap View : With current network growth of bitcoin we can confidently say that we will be seeing more and more countries take this route. Reducing remittance fees has a direct impact on the GDP of some smaller nations that are forced to deal with larger national currencies (Dollar, Euro, Yuan). The benefit to their citizens as well is huge which is also a big political win if you can usher in this benefit to your nation. Watch this space, it is going to get interesting!

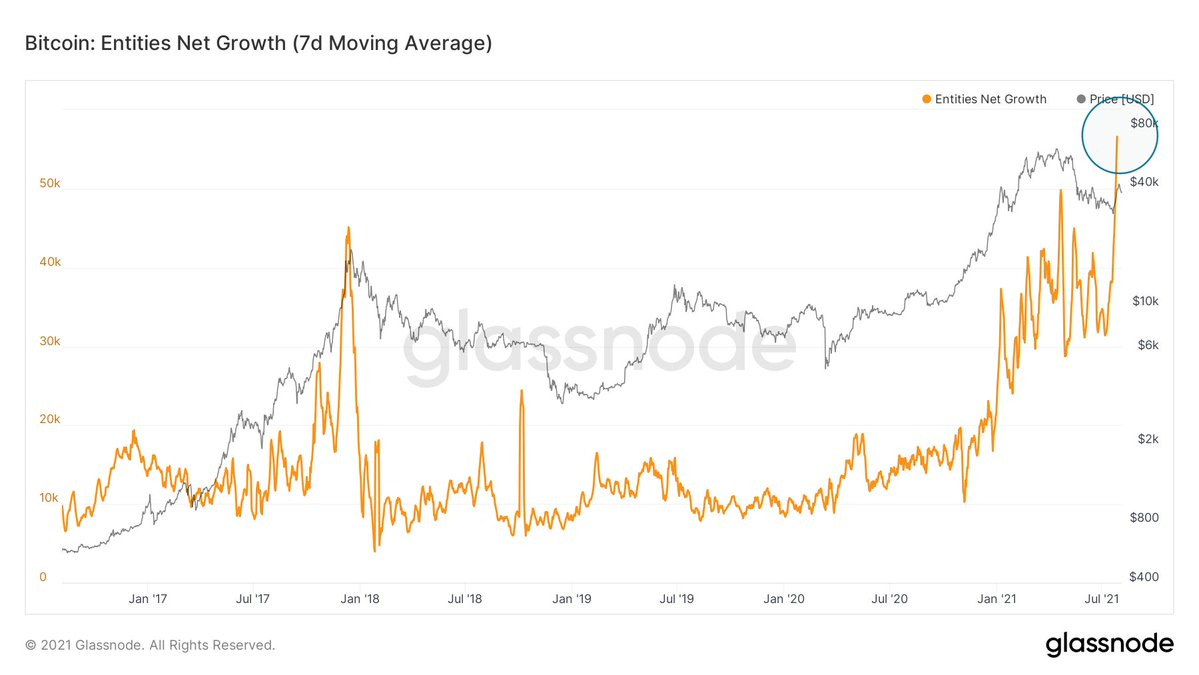

Bitcoin entities hitting all time high!

The Wealth Gap View : This is strong! Shows the number of participants on the network is growing and rapidly breaking 2018 peaks but with a more logical trajectory up and to the right. Bullish activity!

Ethereum - EIP-1559 launched last week

EIP-1559 is an upgrade to the ethereum network that will see gas fees (payments to make transactions) burned/destroyed rather than distributed to miners. This might not make Ethereum a deflationary asset but it certainly brings it close and significantly reduces the amount of ETH in circulation. Bullish sign for ETH holders.

The Wealth Gap View : This potentially makes ETH a more “Scarce” asset on its own network (using the burn mechanism) as less units will be available over time. Likely over time if they pull the upgrades on route to 2.0 then we will likely see very strong price action with Ethereum in the coming months to factor in this change. So far the upgrade seems to be working well and the mainstream media is writing about big new prices that ETH could reach (good click bait). Bullish with caution here!

Till next time

The Wealth Gap Team