El Salvador Embraces Bitcoin

On 8th June 2021 the El Salvadorian congress embraced Bitcoin as a legal tender alongside the US Dollar. By the 17th June the World Bank had rejected El Salvador’s request for assistance in making it a reality, citing concerns about transparency and the environmental impact of Bitcoin mining. Despite this being a monumental step for bitcoin the crypto markets have dropped across the board since the announcement.

Wealth Gap View

We are not surprised that the World Bank has refused to help. Bitcoin is not their area of expertise and institutions rarely give up power or take actions that reduce their influence. As the World Bank’s own Articles of Agreement state “The Bank shall accept from any member, in place of any part of the member's currency, paid in to the Bank” (https://www.worldbank.org/en/about/articles-of-agreement). This seems to be at odds with what their current stance. Let’s see how it plays out.

We are not sure their current justification for not playing ball will hold up. Give them time though, El Salvador dropped this bombshell and legislated for it in record time. Big institutions aren't known for reacting quickly.

Crypto Markets take a plunge

The crypto markets have taken a plunge over the last few weeks. A lot of this appears to be as a result of China clamping down on its Bitcoin miners. China is pro blockchain but anti crypto trading. In September 2017 the Chinese government released a comprehensive ban on Initial coin offerings (ICO’s) describing them as an illegal funding activity. More recently China has been making stronger moves against crypto miners, effectively forcing them out of the country.

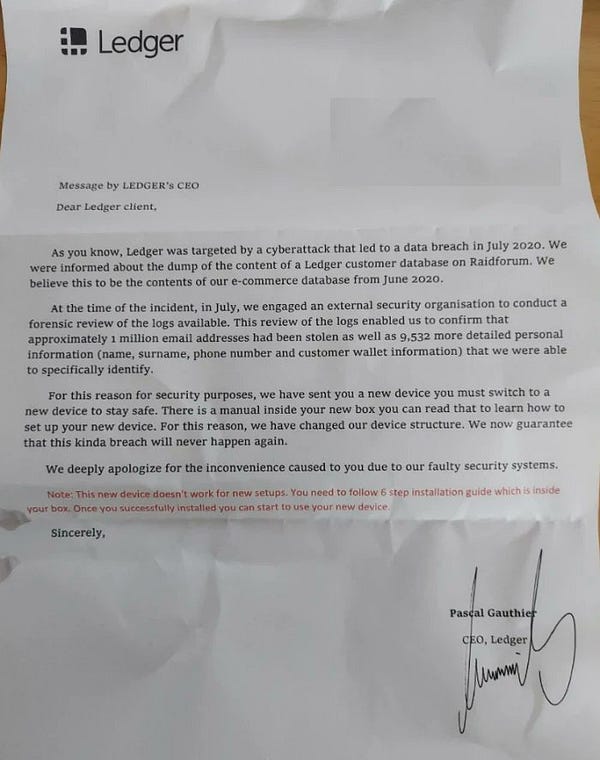

Watch out for the Nano Ledger Scam

Nano Ledger is one of the safest ways to secure your crypto. By holding your crypto in a ‘cold wallet’ any would be thieves would need access to the physical device in order to steal your assets. That is of course unless you get tricked into entering your seed key into a hacked device as was the intention of the scam above.

The takeaway from this is that social engineering is the most effective way to liberate you of your assets.

John McAfee is reported to have committed suicide whilst in his Spanish Prison hours after a Spanish Court agreed to extradite him to the US

Conspiracy theories were quick to circulate around the 75 year olds death, many of which were pushed by old tweets from the deceased:

McAfee was due to be extradited to the US to face tax evasion charges.

Financial Conduct Authority (FCA) asks you about Crypto

The FCA released their late market research findings this week on crypto consumers. Headline figures below:

78% of UK Adults have heard of cryptocurrencies but understanding has decreased

More people now hold cryptocurrencies

Median holding has risen from £260 to £300

Most Crypto holders are professional males over 35

Consumers who are persuaded by adverts are much more likely to regret their purchases

Most consumers use an exchange and check their balances daily

About half of crypto users plan to buy more

No one likes or understands stable coins

https://www.fca.org.uk/publications/research/research-note-cryptoasset-consumer-research-2021

In Summary

Not a lot of good news for the cryptocurrency space this week although there is nothing here that concerns us over the long term. McAfee was a huge crypto advocate and once threatened to eat his own ‘d**k’ if Bitcoin was not worth $500k by 2020.

China finally cracking down on cryptocurrencies was also expected, even if it isn’t welcome. A censorship resistance currency was never going to fly with authoritarian Chinese Communist Party (CCP). By cracking down on the miners the CCP has finally forced them out of the country. Expect them pop up in other jurisdictions in the coming months (particularly the US).

Until Next time

The Wealth Gap