According to an anonymous source, Amazon is ‘apparently’ gearing up to offer payments in bitcoin by the end of the year and launching its own token in 2022

The sit down between Elon Musk (Tesla), Jack Dorsey (Twitter) and Cathie Wood (ARK)

Giant Bitcoin Miner (Core Scientific) goes public

Amazon “apparently” prepping to offer payments in bitcoin by 2022

Amazon posted a job offering here for a Digital Currency and Blockchain Product Lead. This was followed by an ‘anonymous insider’ claiming Amazon was gearing up to offer payments in Bitcoin by the end of 2021 and its own cryptocurrency for 2022.

The Wealth Gap View: The job listing is interesting but if the Trump years taught us anything it’s that anonymous insiders can be found to tell you anything you want to hear. It fits that Amazon would be providing Bitcoin functions as adoption increases but the job listing doesn’t confirm any of this, it only insinuates that the role involves looking at this space. We will monitor this over the coming months and feedback in future Crypto Watch updates. Having said that, we would be amazed if Big Tech aren’t already eyeing Bitcoin opportunities and how to profit from it.

Elon Musk, Jack Dorsey and Cathie Wood sat down at the ‘B Word’ conference to chat about bitcoin

Elon Musk (Tesla), Jack Dorsey (Twitter) and Cathie Wood (ARK) came together (via webcam) to chat about bitcoin. Elon and Jack had been drumming up hype ahead of the event. You can watch it free here if you wish.

The Wealth Gap View: After watching the full interview here at TWG HQ we can happily report that the general consensus was overwhelmingly positive, bullish and future focused. A lot of the initial FUD (Fear, Uncertainty and Doubt) around energy has seemingly been put to bed now that China (dirty coal mine electricity) is no longer such a large part of the mining effort. Elon in our opinion is still “sensitive” to this topic, most likely due to his interests in both Tesla and Government Green Incentive drivers. Musk also confirmed that his private holdings include Bitcoin, Ethereum and Dogecoin with the largest allocation going to Bitcoin. Bullish

During the interview Elon (“I do not respect the SEC”) was wearing the best T-shirt possible that likely underlines his personal feelings. As a billionaire CEO, Elon can move markets with a single utterance and has to be careful in case he upsets the regulators (again lol!).

Symbology is strong in this one.

Another giant Bitcoin Miner is going public

As the exodus of mining rigs out of China (painfully stupid decision) continues, we are seeing North America pick up the slack. The US has ramped up mining investments as those miners seek out access to cheap electricity.

"A trillion dollar mistake” - Michael Saylor on the China Crypto mining ban

The Wealth Gap View: We feel the fundamentals driving the core thermodynamic relationship between mining bitcoin and the need for cheap electricity is going to be the biggest driver of innovation in sustainability around the globe.

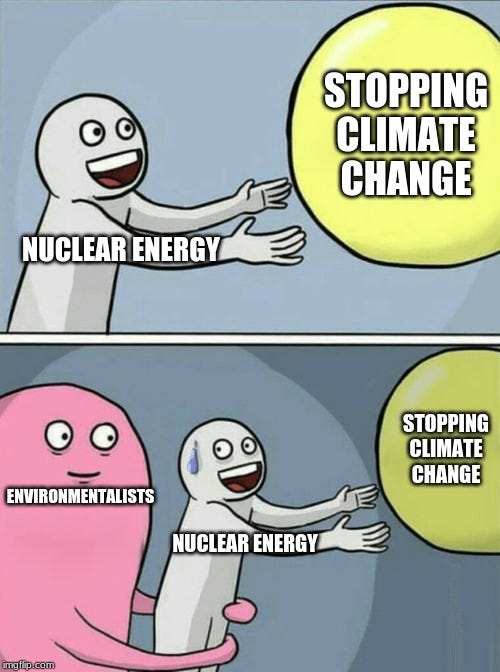

The incentive model is clear as the proof of work model rewards Bitcoin miners for getting electricity at the cheapest price points to mine profitably. This in turn could drive HUGE investment into renewables, clean tech, innovation and desire for reliable supply. Namely we see this coming from the symbiotic relationship between nuclear energy and bitcoin mining.

Also, Bitcoin mining can capture current waste energy from traditional fossil fuel plants. Check this out:

This setup is capturing flare waste gas to mine bitcoin.

Oil and gas wells in hydraulically fractured (“fracked”) shale formations produce some waste gas as a by-product, mostly composed of methane. Since selling this gas is usually unprofitable, it’s typically disposed of by burning it off. Those little flares, from thousands of wells around the world, add up. Gas flaring is responsible for at least 1% of global carbon emissions, and collectively wastes hundreds of millions of dollars worth of natural resources every year.

As you can see from the above there is huge potential for Bitcoin to actually come to the rescue by way of both reducing harmful carbon and methane waste from flaring and also provide profitable incentive to do so for the oil and gas industry. We see this market booming over the next 5-10 years as mining infrastructure is deployed around the world.

Till next time

The Wealth Gap