Crypto Watch 016

Bitcoin has hit a new all time high (ATH) and everyone is excited!

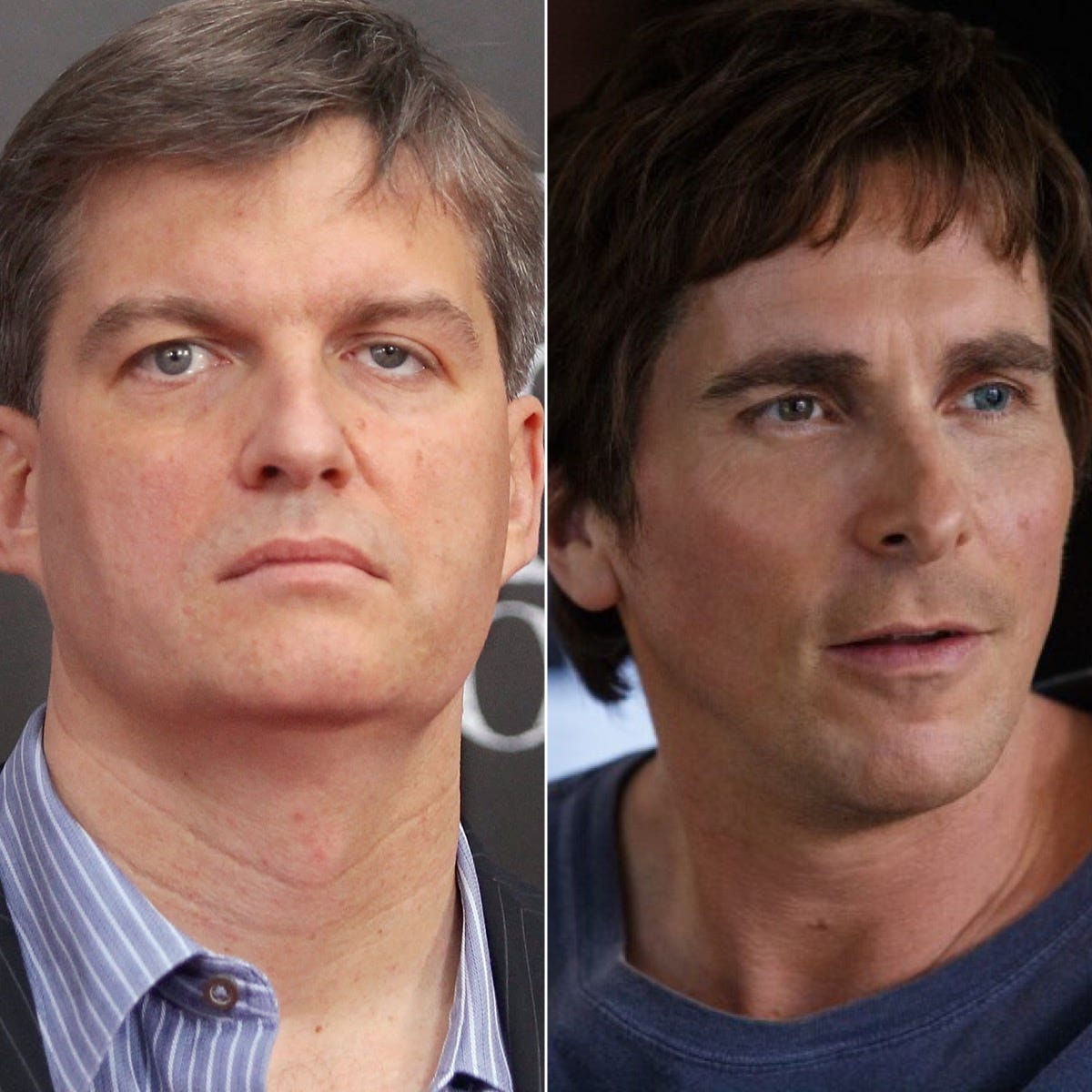

Everyone Except Michael Burry. He Thinks Bitcoin Is In A Bubble

Michael Burry, who famously called the 2008 Great Financial Crash, thinks Bitcoin is in a bubble as most investors don’t understand it. As Burry also recently asked Twitter how to short Bitcoin he isn’t wrong about people not understanding it. The death of Bitcoin has been called over 400 times by prominent voices to date. He hasn’t called it’s death but everyone knows Bitcoin swings wildly so he may feel his position is justified during the next bear market, until that bear market is over anyway.

He also cancelled his Twitter account because the Crypto Cyber Hornets were being mean. Poor Michael.

Fixed Income Colossus, Pimco, Plans To Buy More Bitcoin

The $2.2 trillion asset manager has already dabbled in crypto-linked stocks and is looking to buy more. Read about it here.

Bitcoin Exchange Traded Fund (ETF) Launched in US

The ProShares Bitcoin Strategy ETF (BITO) launched on Tuesday to general fanfare, becoming the second highest fund traded ever. It is the first U.S. bitcoin-linked ETF designed to provide investment results that generally correspond to the performance of bitcoin. The fund seeks to provide capital appreciation primarily through managed exposure to bitcoin futures contracts. The fund does not invest directly in bitcoin.

With all this bullish news Bitcoin has hit all time highs (ATH).

Is This The Moment Cryptocurrencies Go Mainstream?

The launch of a Bitcoin ETF in the United States is a welcome step towards mass adoption. At The Wealth Gap we would argue that it will not just be the Western Economies that drive Bitcoin into the mainstream it will also be the developing world. El Salvador was the first country to make Bitcoin legal tender, Bitcoin adoption is being driven by people around the world who are subject to shitty local fiat currencies that are constantly being debased.

Nigeria has seen an astonishing uptake in crypto payments as government has frozen the accounts of its critics while the local Naira suffers appalling levels of inflation.

Venezuela’s Bolivar has suffered excruciating hyper inflation over the years which has forced the population to find alternatives.

The central Bank of Brazil notes that Brazilians have bought $4bn worth of crypto this year.

Bitcoin could represent a financial revolution. As uptake increases the price will rise and the volatility will reduce. There are still a huge amount of speculators gambling on the price but that will change over time as more and more people move to purchasing goods with it.

Being early means that the developing world will get access to bitcoin and this could lead to the greatest transfer of wealth in human history. Should nation states reject the existing financial system (controlled by the West) and instead choose to deal in crypto we will see a flourishing of the ecosystem. The West may be forced to buy crypto to continue trading with the developing world.

Bitcoin cannot be controlled. It provides an alternative to the government controlled currencies we have had to accept for generations. As we speak our leaders are debasing our currencies to pay for their own reckless spending and bailing out companies that are apparently too big to fail. Don’t be fooled by the narrative, we are all paying the price in that secret hidden tax called inflation.

Prices are not rising, the value of money is falling. Bitcoin provides an alternative to this system.

Until Next Time

The Wealth Gap