If You Are Locked In A Viscious Cycle Of Debt It’s Not Neccessarily Your Fault

In a world of hyper consumerism the average person is stuck in a constant battle of ‘one-upmanship’ with everyone else on the planet. We are inundated with pictures of our beautiful peers enjoying perfect luxurious lifestyles. This pressure to ‘be’ rich and happy can be devastating to our health and finances as we are constantly seduced into buying stuff we can’t afford using credit cards and loans which are so easy to acquire. What’s worse is the further you fall the harder it is to climb out. The purpose of this article is to remind you that you are not alone and that there is a way out.

What Is Personal Debt & How Does It Work?

Debt is the act of one party lending money to another party. The Debtor (you) agrees to pay a premium for borrowing the money from the Creditor (bank). In the western world this is usually an Annual Percentage Rate (APR) of the borrowed amount while in the Islamic world the amount you pay back is agreed at the beginning of the contract.

Debt is big business and makes up a huge part of the financial world. Personal debt involves you borrowing money from a bank or credit card company. We would argue that there are two types of personal debt:

Good (Planned) Debt

We would consider any debt that you know you can repay ahead of time to be good debt. Here are a couple of examples of good debt:

Buying a car on finance that allows you to travel to a job that will allow you to repay the debt

Buying an asset that will help you earn more money (and pay itself off)

Taking out a loan to buy a new boiler because you cannot afford the upfront cost but can afford to pay monthly instalments

Bad (Unplanned) Debt

We would consider bad debt to be any debt that you accumulate without having a manageable repayment plan. Examples are as follows:

Credit card debt that just keeps growing

Debt with unmanageable payments

Student Loans (yes really! We don’t know any students that appreciate the debt they are taking on before going to university and the impact it will have on their lives)

Lending Money from the Creditors (Banks) Perspective

Banking has historically had a pretty straightforward business model:

A Saver deposits money to the bank for safe keeping

The Bank lends the money to a borrower for a fee (interest rate)

The Bank splits the borrowers fee between the saver and the bank

Back in the day Banks could only lend out the money they have. Banking in recent years has gotten a little more complicates as a result of Fractional Reserve Banking which allows Banks to lend out more money than they actually have.

This means when you take a loan from the bank a decent chunk of the money you are borrowing has been magicked out of thin air….

Fractional Reserve Banking is designed to keep the economy growing and allows the Banks a lot of power (and responsibility) over our lives.

What Actually Is Your Credit Rating?

Your credit score is a system the banks use to help them decide if they will lend you money. The more money you have borrowed and repaid the higher your score will be.

As you can see the highest score you can get with Experian is 999. You can find out what your credit score is using one of the three credit score agencies: Experian, Equifax (hacked in 2017) and TransUnion (charges may apply).

Why Should You Care?

The higher your credit score the more money you can borrow and at better rates. If you have a low credit score Banks are taking more of a risk with you, are less likely to offer you money and will only do so at higher rates of interest (because you are higher risk).

How To Boost Your Credit Score

Make sure you're registered on the electoral roll.

Check for any mistakes on your credit report.

Try to pay any bills or other credit repayments on time.

Check if you're financially linked to another person, for example through a mortgage or joint bank account. If that person has a low credit score, it will affect yours as well.

Check for fraudulent activity on your credit report. For example, if someone applied for credit in your name without your knowledge.

Try and reduce any outstanding debt or clear it off completely.

Debt Problems

If you are doing any of the following you could be in trouble:

Using debt to pay everyday bills

Considering taking out a consolidation loan to reduce monthly payments

Paying no more than the minimum payments due on credit cards

Using your credit card to take out cash advances

Using a credit card to pay your mortgage

Borrowing money without knowing how you are going to pay it back

What To Do If You Are In Trouble

If you are doing any of the things mentioned in Debt Problems above its probably time to take action. The following are the options available to you.

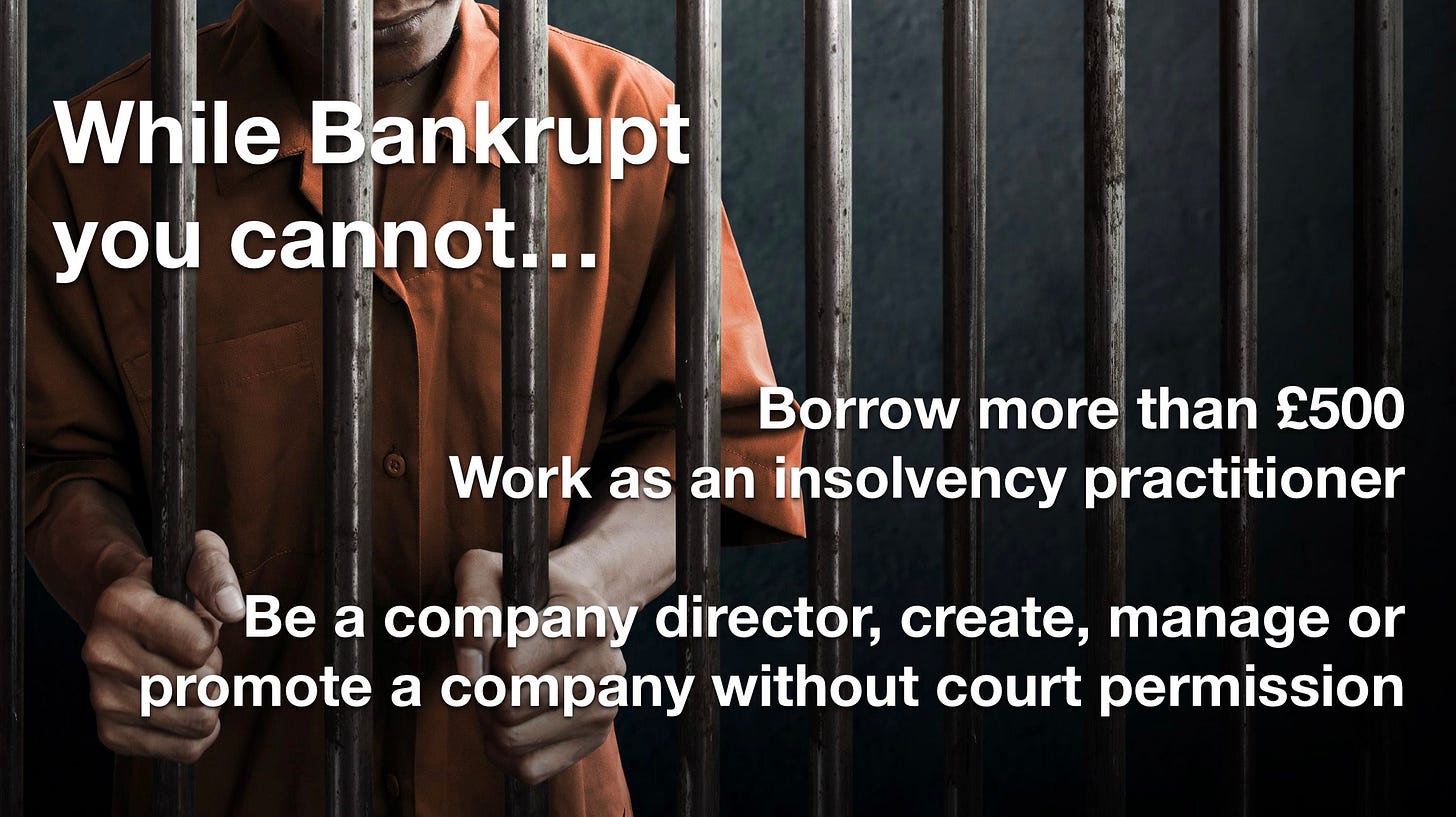

Bankruptcy

A Bankruptcy application can be made by you OR a 3rd party (creditor)

No minimum debt

Can apply to online. Application is considered by an adjudicator

Most of your assets will need to be sold but you can usually keep items needed for work and household items (Clothing, bedding, furniture etc).

You also have to hand over all your bank account details. You can get money released to pay for food though.

You usually get to keep your pension assets (but not your pension income).

Debt Management Plan

An agreement between you and your creditors to pay off your debts

Typically used if you can only afford small monthly payments

Can be used to pay off unsecured debts (credit cards etc but not a mortgage)

Can be set up directly with creditor or through a debt management company (for a fee)

Can be cancelled by creditor if you don’t keep up payments

Administration Order

There must be a County or High Court Agreement against you that you cannot pay in full. You agree to one monthly payment to the court and they pay your creditors

Debt must be less than £5,000

Must have at least 2 creditors

Must be able to afford regular payments

Court decides the repayment schedule

You may be able to continue running your own business

Individual Voluntary Arrangement (IVA)

An agreement between you and your creditors arranged through an Insolvency Practitioner (IP). Any unpaid debts that were included in the IVA are written off when the arrangement is completed.

75% of creditors must agree

IP will work out what you can afford and agree repayment with creditors

IVA added to Individual Solvency Register & removed 3 months after IVA ends

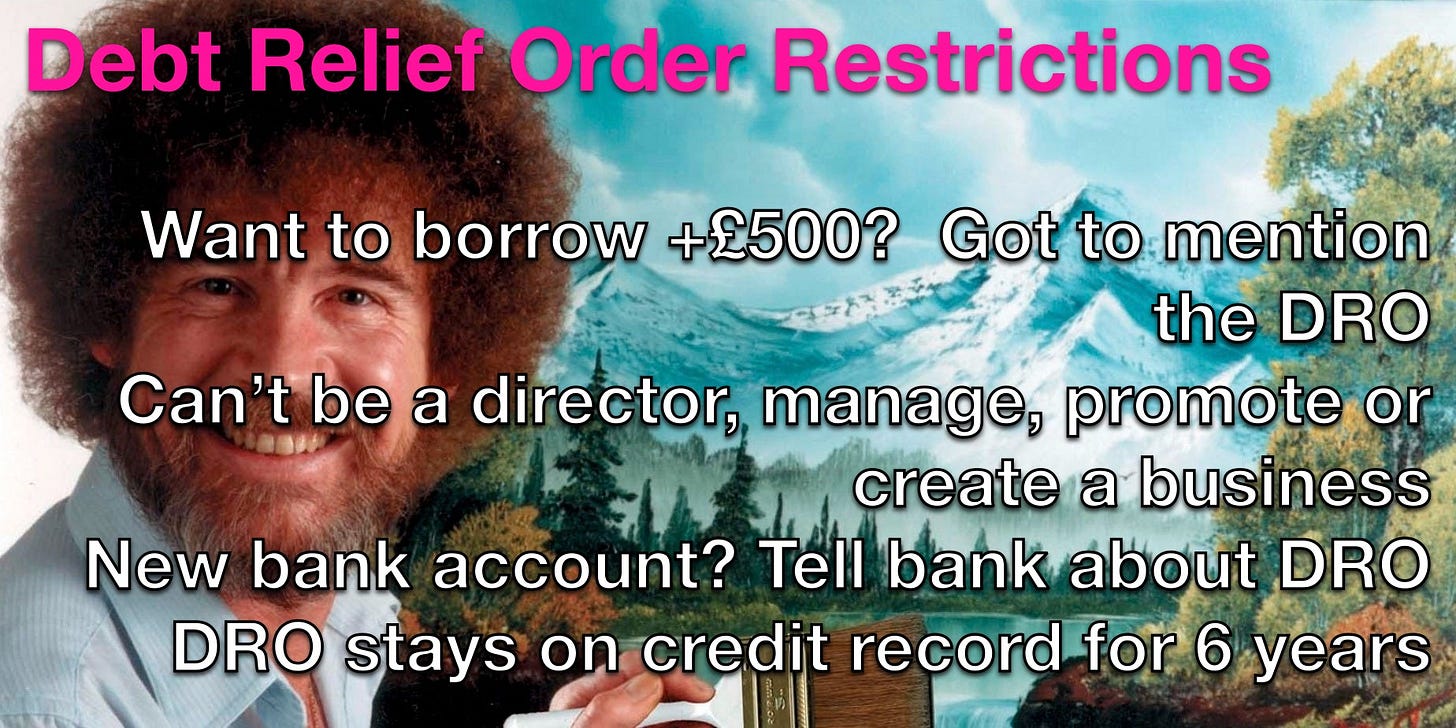

Debt Relief Order

An agreement made through an Official Receiver. This can be a way to get your debts written off if you owe less than £20,000 and have less than £1,000 worth of assets. You can’t own a home either. There are loads of catches so here is Bob Ross to explain:

Check Out the National Debtline Here For Further Help

You should never stick your head in the sand regarding your debts. Lenders are making a lot of money off you for their shareholders. Debt forfeits are baked into the business model and a desperate financial situation for you is just a business decision for them.

Work Out What You Owe

Work Out What You Can Afford To Pay Back

Talk To Your Creditors

Until Next Time

The Wealth Gap

Greetings, I want to share with you a link to my Web page section that deals with money, credit, and debt:

https://www.questionuniverse.com/rethink_economics.html#crebt

Questioning the Universe Publishing (QUP) {Irucka Embry]: Resources to help us rethink E-CON-omics: The True Nature of “Money” & “Credit” and “Debt”

Thank you in advance.

Irucka Embry

Greetings, I want to share with you a link to my Web page section that deals with money, credit, and debt:

https://www.questionuniverse.com/rethink_economics.html#crebt

Questioning the Universe Publishing (QUP) {Irucka Embry]: Resources to help us rethink E-CON-omics: The True Nature of “Money” & “Credit” and “Debt”

Thank you in advance.

Irucka Embry