Is Bitcoin worse than a Ponzi Scheme?

There is a pushback from the mainstream investment industry against Bitcoin

In a recent opinion piece for the Financial Time (which can be read here), Robert McCauley (non-resident senior fellow at Boston University’s Global Development Policy Centre and associate member of the Faculty of History at the University of Oxford), takes aim at Bitcoin and states that it is worse than a Ponzi scheme. Here we will address the concerns he raised and also point out the features he has overlooked.

McCauley first points to a post by computer scientist Jorge Stolfi who lists the following observations on what makes a Ponzi scheme:

Investors buy in the expectation of profits.

That expectation is sustained by the profits of those that cash out.

But there is no external source for those profits; they come entirely from new investments.

And the operators take away a large portion of the money

These aren’t really true for Bitcoin. Here is a gentle pushback from the Wealth Gaps perspective:

Investors in the West initially buy Bitcoin with the expectation of profits. Investors in the developing world often buy to escape the crushing inflation and corruption running amok in their local government’s currency. A lot of these people are unable to get bank accounts but they do have smart phones and can download a Bitcoin wallet. This allows them to ‘Bank’ and save using Bitcoin.

Afterwards investors start learning about Bitcoin and a large portion of them begin to buy into the Bitcoin ideology and start buying more Bitcoin to protect themselves. In Bitcoin circles this is called getting ‘red pilled’.This is true initially but when someone is red pilled they stop thinking about wealth in fiat (USD/GBP) terms as they now recognise fiat currencies lose value over time.

This one is also kind of true although in the Bitcoin community we refer to this as the rate of adoption. It’s also important to point out that Bitcoin is being used instead of local government currencies in some countries (Nigeria) and that continuing mismanagement of government currencies will see the adoption rate increase further over time

There are no operators of Bitcoin although to be fair you could argue that early adopters cashing in could sort of qualify under this criteria.

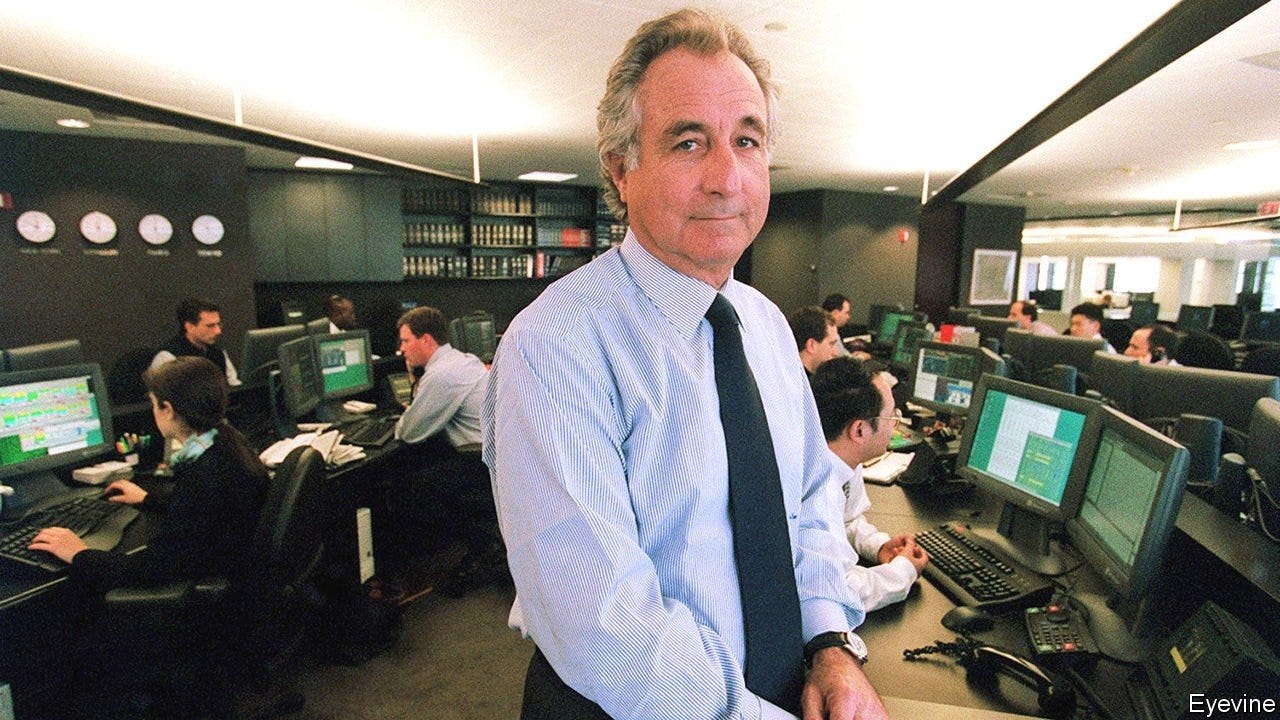

The article then dives into history with a look at the original Ponzi scheme (run by Charles Ponzi) and finally a look at Bernie Madoff. McCauley seems to think that Bitcoin is worse than a Ponzi Scheme because there is no legal recourse for holders of Bitcoin should Bitcoin fail (Bitcoin doesn’t care).

McCauley thinks a collapse in Bitcoin could be triggered by a run on a Stablecoin. A Stablecoin is typically backed by a government currency (USD) and should hold 1 dollar for each dollar of crypto it has in circulation. Stablecoins need to keep their reserves high as they are unregulated and you need a banking license to lend money you don’t have (lol).

The rest of the article is a bit of a moan. McCauley does not appear to understand Bitcoin at all and its hard to address his concerns as aside from the ‘its a Ponzi scheme’ checklist he has not provided any.

Yes Bitcoin is volatile

Yes Bitcoin’s value can go down hard

Yes the network uses electricity to keep it going

Final Thoughts

Bitcoin sceptics are praying that Bitcoin fails as they will be vindicated in their beliefs. The problem is the Bitcoin price has collapsed multiple times only to rise from the ashes bigger and greater than before. We are now looking at a massive decentralised network of miners scattered around the globe operating a financial network that cannot be controlled or regulated by any authority. In the end the price is irrelevant, it could go to zero (which it won’t) and it would not matter. Meanwhile the Bitcoin sceptics are pricing assets mentally in a government money where the supply is increasing exponentially. It can’t feel good knowing that the money you carefully saved over decades can be magicked out of thin air over at the central bank for next to no cost. Kind of puts a dampener on the whole endeavour.

The truth of the situation is that the existing financial system isn’t really working for the millennials or the younger generations. Gone are the days when we could buy a house and raise a family on a single income. The establishment elite are trying to patch it up as best they can but ‘The Great Reset’ feels more like a propaganda piece to guilt people into not wanting a better life.

Bitcoin replaces the establishment, its central banks and its money with a nifty piece of software that the cannot be destroyed or manipulated by people.

Sounds promising doesnt it.

Until next time

The Wealth Gap