Warning! If you don’t like great information that involves reading and would prefer looking at 30 second Tik Tok videos because you are dopamine slave then probably skip this one as we go in depth and take time to break down great work.

Still here, well done! Lets crack on

Metcalfe’s Law is a concept used in computer networks and telecommunications to represent the value of a network.

The law states that a network's impact is the square of the number of nodes in the network. For example, if a network has 10 nodes, its inherent value is 100 (10 * 10). The end nodes can be computers, servers and/or connecting users.

The law was conceived by George Gilder but is attributed to Robert Metcalfe, co-inventor of Ethernet (1980). Given that the Internet as we know it today was not around when the Law was formulated, it spoke more to the value of devices in general. For example, owning a single fax machine is useless. When there are two fax machines, you can communicate with one other person, but when there are millions, the device value increases exponentially.

Over time Metcalfe’s Law was linked to the Internet's substantial growth and how it works in-line with Moore’s Law. The concept is similar to the business concept of a "network effect" in that the value of a network provides both additional value and a competitive advantage. For example, eBay may or may not have had the best auction website, but they clearly had the most users. Because this is so difficult to replicate, the power of the network drove out other competition.

Moore’s Law

Moore’s law isn’t really a law but more of an observation. Moore ‘observed’ that the number of transistors on a microchip doubled about every two years, the suggestion being that technology grows at an exponential rate.

Jeff Booth (author of The Price of Tomorrow) uses the following example:

If you could fold a piece of paper in half 50 times, how tall would that stack be? We guessed 3-4 inches until we cracked open excel. Turns out that paper would reach the sun (evidenced below).

Metcalf’s Law and Moore’s law complement each other as the growth of technology and the expansion of networks feed off each other to generate exponential growth of the technology industry.

The impact on Bitcoin

We want to highlight some of the very interesting work outlined in Jurrien Timmers twitter feed addressing Bitcoin, Metcalfe’s law and the network affect.

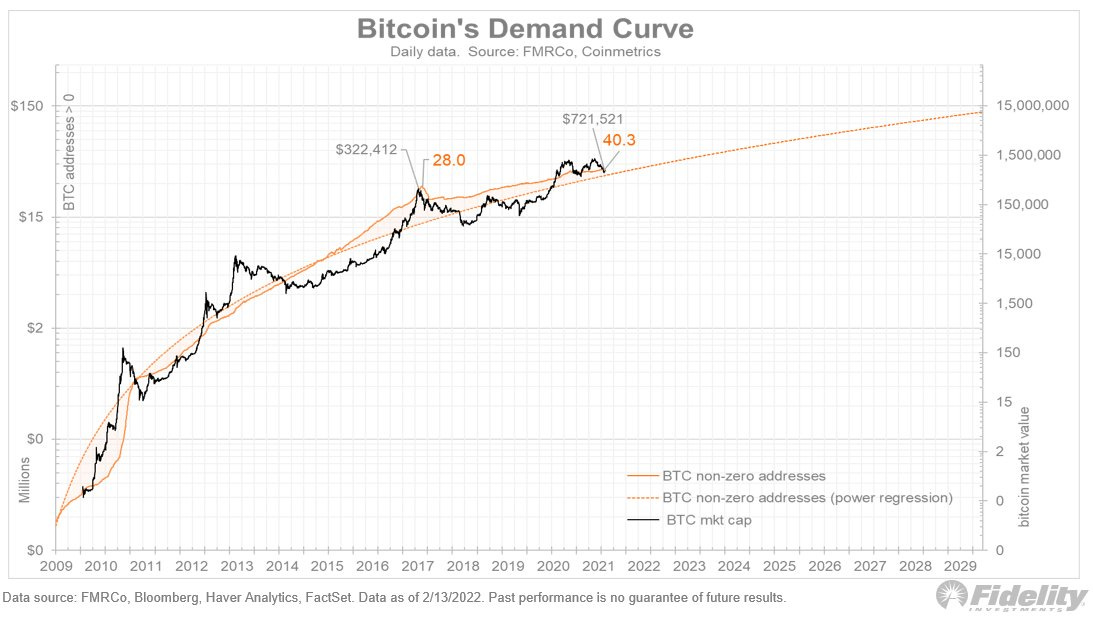

Jurrien observes the Up and Down debate in Bitcoin pricing is just noise, what matters is the network growth and where it is going. He points out it is clearly going ‘Up and to the Right’. The below chart shows the growth in bitcoin addresses following a power regression curve.

Apple (A useful comparison)

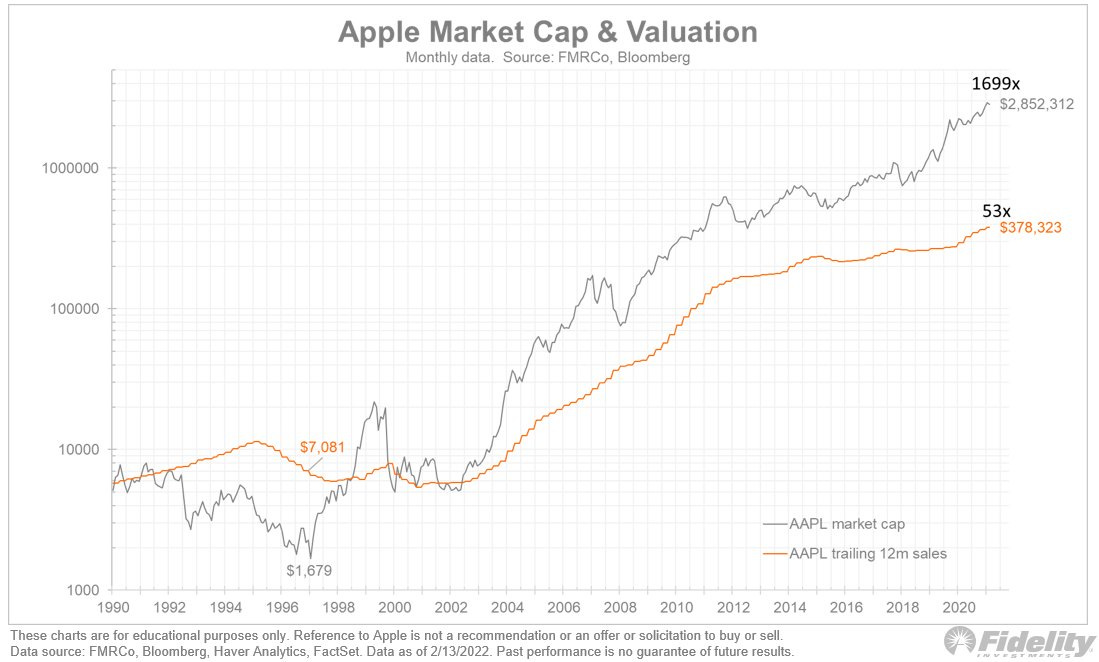

Jurrien uses some creative licence in his general thesis and applies Metcalfe’s Law to Apple. He takes Apples network (crudely measured as its trailing sales) and shows us that is has increased 53x since 1996 while the market value has increased 1699x.

So… if we apply Metcalf’s law (square the network growth) to Apple’s market value then it should have increased 2855x. At 1699x it is on its way there!

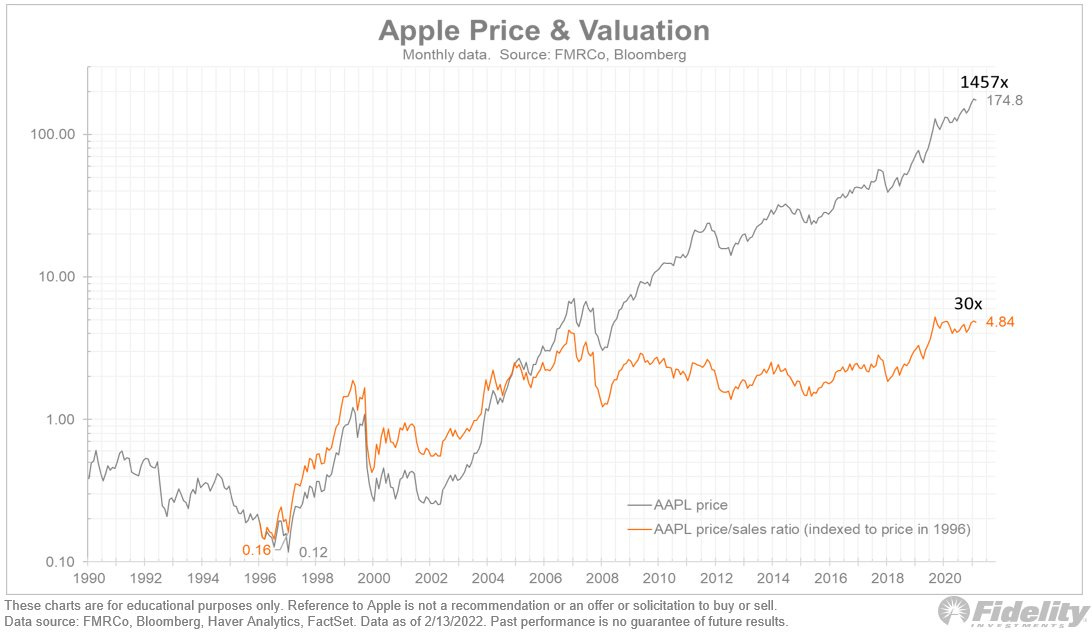

Since 1996 Apple’s price has grown by 1257x, while its price-to-sales ratio has grown 30x as highlighted in the chart set out by Jurrien below.

Breather time - here’s a picture of a squirrel doing a superhero landing

How was Instagram? - find anything useful…? Didn’t think so 🤡

Right lets continue

Bitcoins Network Growth & Valuation

Below is the 2021 year end price of bitcoin and its “price-to-network ratio”. This is Julian’s attempt at putting a valuation on the network.

Bitcoins valuation has increased 867x since 2011 (orange line), while its price (grey line) has increased and whopping 640,633x.

So if Metcalfe’s law is applied and calculated as the square of 867 we get 751,111. Like Apple, this isn’t far off the 640,633x realised price gain.

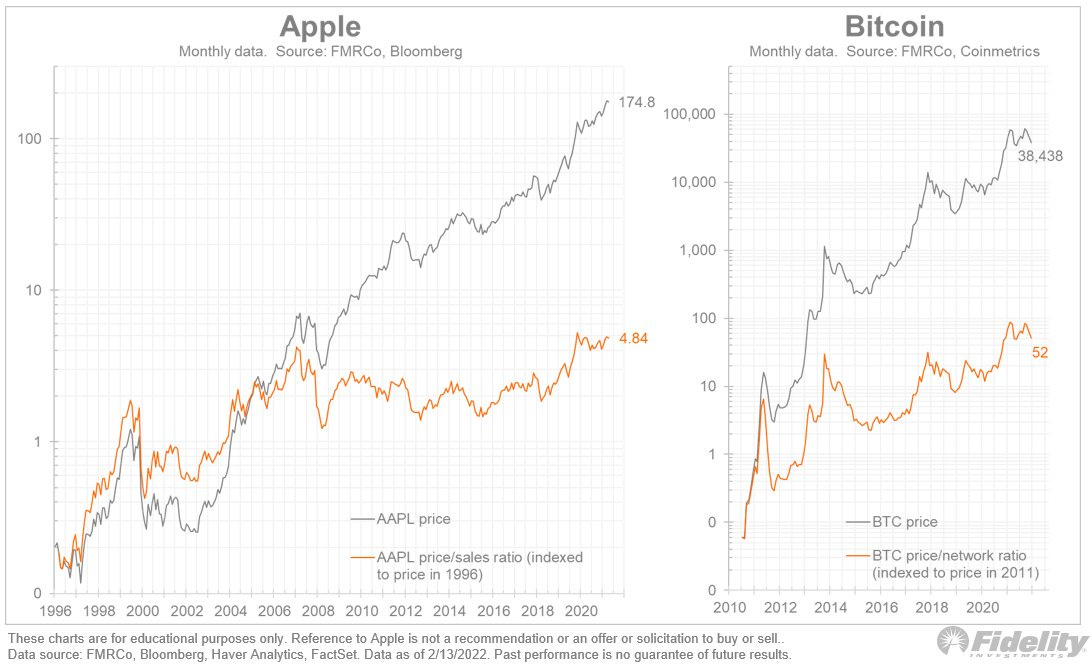

Below is a side by side comparison of the “network growth” both completely different animals but the fundamental path suggests this relationship has merit when assessing the Network Value.

What’s Next for Bitcoin?

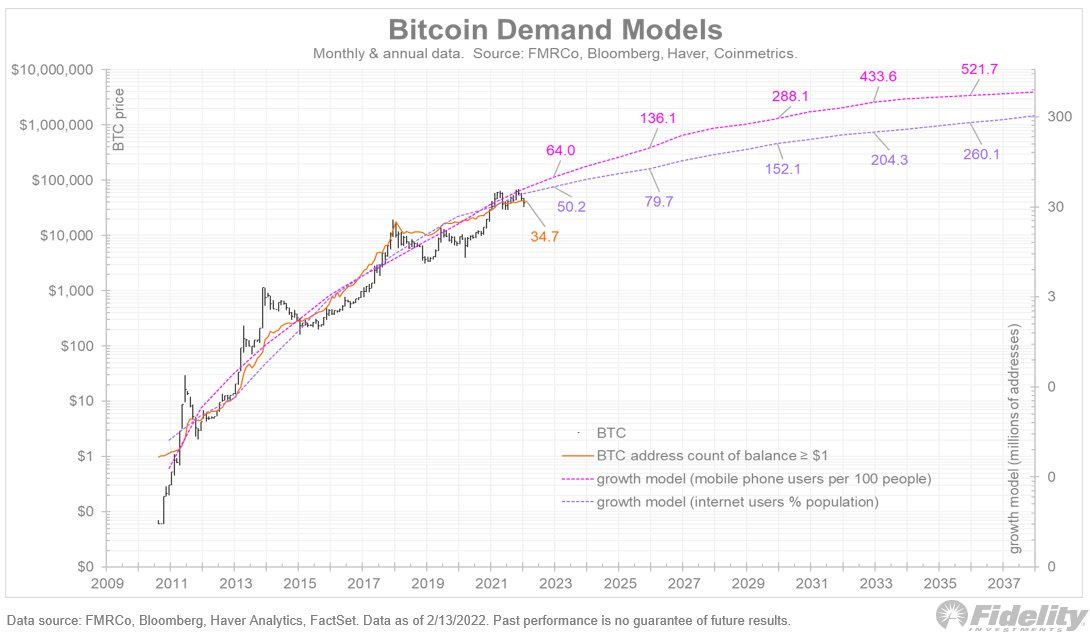

This is where Jurrien nails a fantastic demand curve chart comparison highlighting the growth of Mobile phone subscriptions and internet adoption. These two elements are tangible as you likely have a mobile phone and are using the internet so it’s a “realised” comparison, not a fluffy guestimation of value.

The below chart predicts a longer term trajectory and potential future value of the bitcoin network as it tracks and expands somewhat in line with these two example network growth samples.

The Wealth Gap View: Like carpenters we will whittle away at your wooden fiat heart until you have your eureka moment and see the light. The risk great, nothing is guaranteed but the signs suggest we are sat in the middle of a new global network of value expansion. The beauty is this time every person has the opportunity to purchase “a portion” of this exponential growth and hold that value into the future.

Until Next Time

The Wealth Gap