Politicians Are Scared of Central Bank Digital Currencies

When surveillance is disguised as money, nobody is safe.

TLDR: In the UK and the US politicians have pushed back against plans to build Central Bank Digital Currencies (CBDC’s) because it would give the Central Banks too much information and influence over our lives.

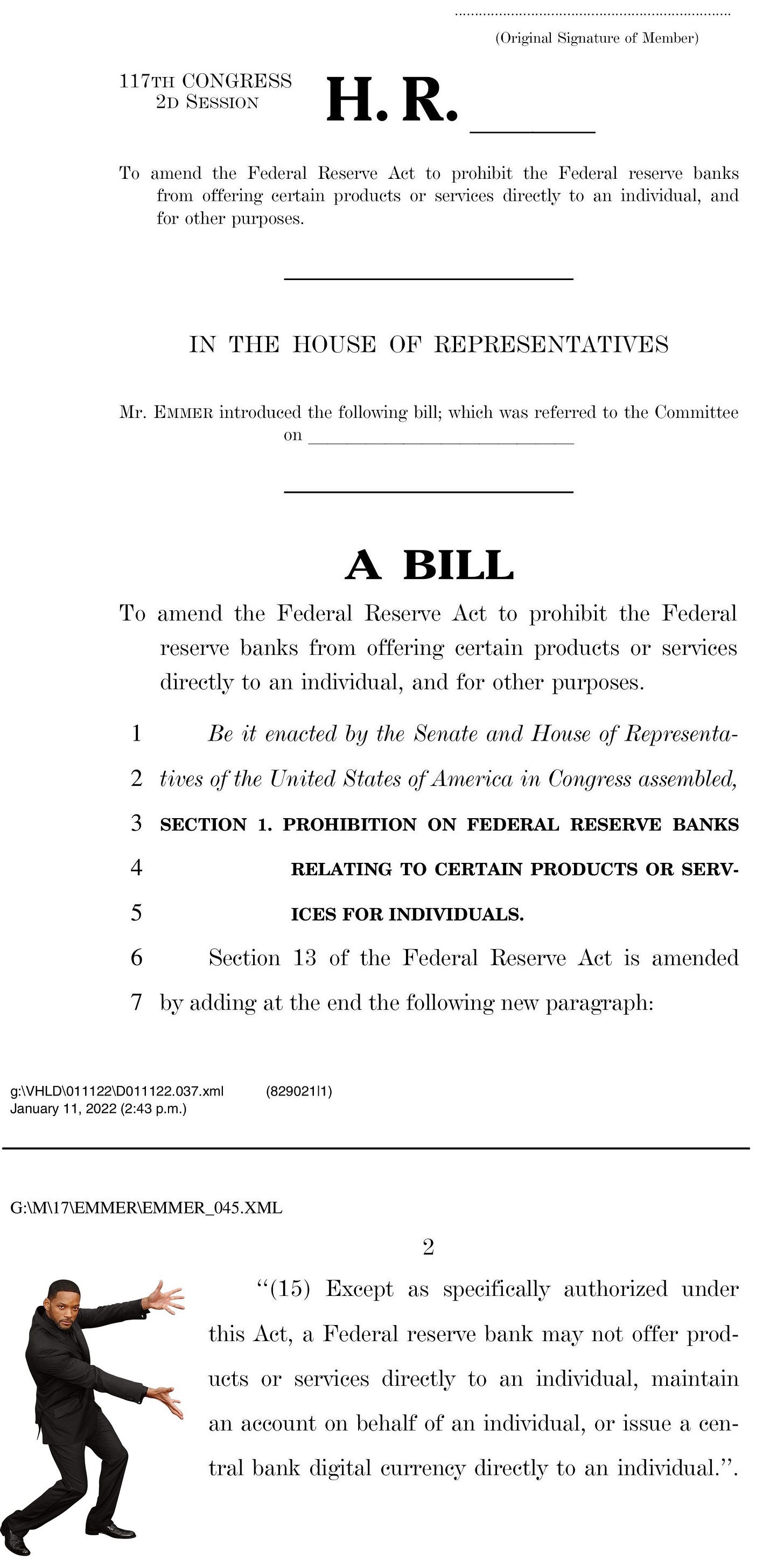

In the US, Congressman Tom Emmer introduced the following Bill which would prohibit the Federal Reserve from launching a Central Bank Digital Currency if passed (Scroll down to Will Smith for the imporant bit):

Emmer also issued the following statement:

“As other countries, like China, develop CBDCs that fundamentally omit the benefits and protections of cash, it is more important than ever to ensure the United States’ digital currency policy protects financial privacy, maintains the dollar’s dominance, and cultivates innovation.

CBDCs that fail to adhere to these three basic principles could enable an entity like the Federal Reserve to mobilize itself into a retail bank, collect personally identifiable information on users, and track their transactions indefinitely.

Not only does this CBDC model raise “single point of failure” issues, leaving Americans’ financial information vulnerable to attack, but it could be used as a surveillance tool that Americans should never be forced to tolerate from their own government.

Requiring users to open an account at the Fed to access a United States CBDC would put the Fed on an insidious path akin to China’s digital authoritarianism.

Any CBDC implemented by the Fed must be open, permissionless, and private. This means that any digital dollar must be accessible to all, transact on a blockchain that is transparent to all, and maintain the privacy elements of cash.

In order to maintain the dollar’s status as the world’s reserve currency in a digital age, it is important that the United States lead with a posture that prioritizes innovation and does not aim to compete with the private sector.

Simply put, we must prioritize blockchain technology with American characteristics, rather than mimic China’s digital authoritarianism out of fear”

The House of Lords (UK) Shares Similar Concerns

A House of Lords committee has concluded that there is “no convincing case” for a CBDC:

“The introduction of a UK CBDC would have far-reaching consequences for households, businesses, and the monetary system for decades to come and may pose significant risks depending on how it is designed. These risks include state surveillance of people’s spending choices, financial instability as people convert bank deposits to CBDC during periods of economic stress, an increase in central bank power without sufficient scrutiny, and the creation of a centralised point of failure that would be a target for hostile nation state or criminal actors”

The Wealth Gap View:

The big takeaway is the total dismissal of Bitcoin as a competitor for government money. Both the US and UK establishments have dismissed Bitcoin as a threat because of it volatility, deciding to focus instead on the stablecoin projects. At the Wealth Gap we are pleased that they have made this mistake as it could well accelerate the demise of the establishments control over the currency. We believe this is a good thing as we don’t think anyone should control the supply of money, especially politicians.

Doubtless we will end up with central bank digital currencies of some sort in the future but not before Bitcoin has soaked up so much trust and value from the current system that manipulating the world through interest rates becomes impossible to achieve.

Until Next Time

The Wealth Gap