In Parts 1 & 2 we covered how the debt markets work before landing on how they can go wrong. For this final instalment which discusses what you can do to survive another global meltdown we need cover the following:

What is Currency

Where does Contagion End?

Why Bitcoin can help

What is Currency

Most currencies in circulation today are ‘Fiat currencies’. The US Dollar, The EU Euro and the British Pound are all Fiat currencies. Fiat is latin for “let it be done” and a fiat currency is a convenient medium of exchange we use in our everyday lives. The value is derived from pure trust in your government and its ability to direct violence to protect that trust. (Essentially it’s just hot air promise notes)

Government: “This money has value!”

Everyone: “Why though?”

Government: “Because we say so and you will too if you know whats good for you!”

Everyone: “This money has value! Please don’t hurt us!”

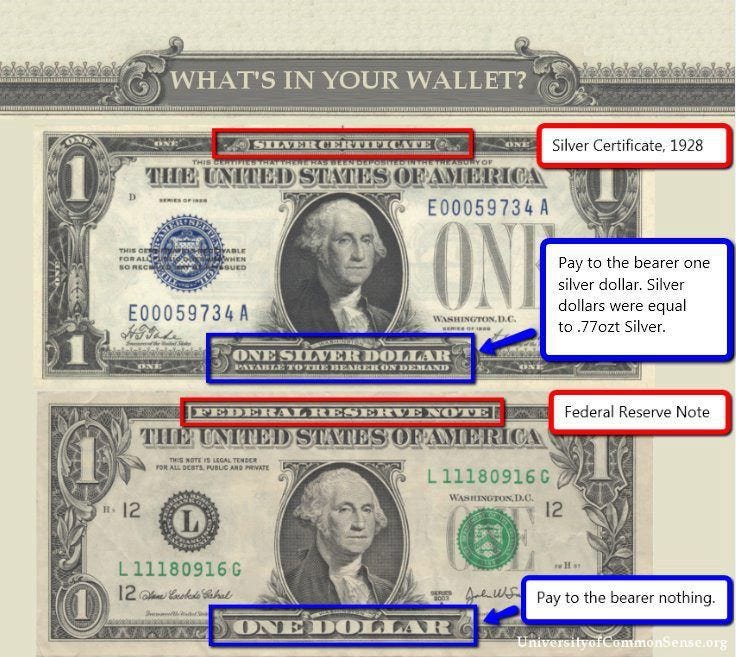

It wasn’t always backed by hot air. Historically currency was based on an underlying claim on Gold. There is a physical and inherent “Value” to Gold and as such it made the currency attached to it a more trust worthy supply of perceived value.

Government: “This money has value!”

Everyone: “Why though?”

Government: “Because you can exchange this paper for Gold!”

Everyone: “Ok Cool!”

What Happened?

By the end of World War 2 most of Europe’s Gold had moved to the US to protect it from Nazi capture and also as payment for materials needed to help the Allies fight the war.

Large parts of Europe were demolished and at the 1944 Bretton Woods agreement it was established that the US dollar would be the worlds reserve currency, backed by gold and all other nation currencies could be pegged to the dollar constant.

What the F**k happened in 1971!?

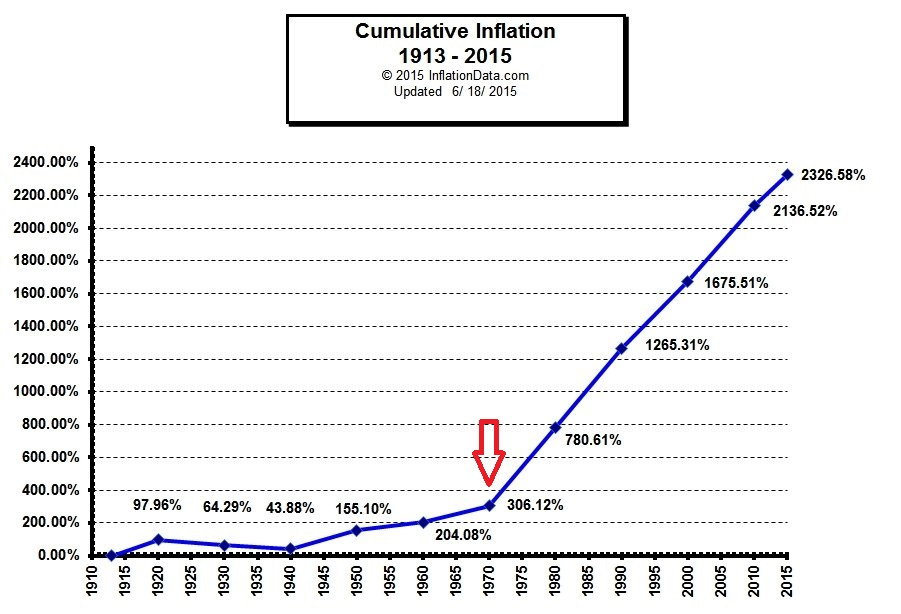

Well… in 1971 that Peg was broken by President Nixon. In doing so he let the currency raft loose in regards to sound money principles in order to realise his short term goals. 50 years later, we have a currency situation in 2021 where all major central banks are printing (debasing) their currencies at the same time to help stimulate economies and have an ever growing and dangerously high level of global debt stacking up on the balanced sheets. Unfortunately they have no choice and will continue to do so until something breaks.

All Fiat Currencies are mathematically designed to debase (lose value) over time as the supply is inflated (printed) and the value per unit drops. The governments have no choice but to continue debasement to support the existing deficit spending as taxation just isn’t cutting it to pay down the debt. In other words we print and spend more than we can tax to cover it.

This cycle of currency debasement by printing instead of creating true “value” in the form of goods or services can continue indefinitely, until it breaks. This is often correlated with the end of a nation/empires effective run (see the fall of Roman Empire, Byzantine, Dutch, Spanish, British Empire and soon the USA). Historically you tend to see the symptoms of money printing going rampant and failure of fiscal and monetary policy actions as precursors of a currency collapse, default or Jubilee of debt. Not that anything like that is happening now… 🙈

Now onto the Contagion

In Part 1 and Part 2 we described and discussed the sheer size of the Credit / Fixed Income market. We now want to state that all other financial instruments would be affected by a default contagion in the fixed income market. We anticipate this next crisis will be more terrible than the 2008 Financial Crisis as the buyers of last resort (the central banks) are already buying corporate debt and bailing out huge swathes of the system around the world.

THERE IS NO WHERE ELSE TO TURN

The Fiat System will continue to prop up the debt creation game and covering that cost for now. The only tool they have left is to keep printing money, constantly kicking the can down the road, hoping something will change. An Interest rate rise just isn’t an option unless they want to be like the joker “some men just like to watch the world burn” .

Scary Stats time

Government Debt

Global debt is now 4 x Gross Domestic Product (GDP)

If the interest rate on Government debt is 3% (which is low) then the global economy needs to grow at 12% (3% x the 4X debt amount) just to keep the tax base in line with the growth of just the debt balance. GDP needs to be 12% a year to break even on debt obligations.

Now factor in all the debt that has been taken on since Covid started. You don’t need numbers to know its a lot.

Bank Debt

If we drop down one level from Nation Borrowing to the Banking system we get to look at fractional reserve banking.

Fractional Reserve Banking is a ponzi scheme which is only legal because the governments have a monopoly on violence. Its a system that lets banks lend out money that they dont have in order to stimulate economic growth. If you have taken a bank loan the majority of that money will have been magicked out of thin air. If you had to work hard to repay that debt you are entitled to feel salty about it.

Banks are considered essential to the economy (currently). Not only do they get to magic money out of thin air but when they screw up they get bailed out by the state because they are considered ‘too big to fail’.

Banks are regularly insolvent on a mark to market basis - Greg Foss

Are you aware that most commercial banks are typically 25x levered on their lending books. So for every $100 in loans they only have $4 in equity at best and the rest is in subordinated debt. This should give you some idea of the scale of which the Debt/GDP spiral could get completely out of hand if there was an incident that kicked off contagion in the credit markets.

We aren’t concerned about the staggering numbers (they are just digits). For us the true issue is when Contagion strikes. The trust will be eroded and the markets will go to a No Bid scenario where regardless of price, these instruments will not be bought as no one believes in the potential return. A valuation freefall will insue meaning the sell price is essentially ZERO and the whole thing starts to unravel at a frightening pace.

Bitcoin is different

Bitcoin cannot be debased, controlled or manipulated by nation state actors. It’s value is based on mathematical certainty, it’s resistance to censorship and has the ability to move across border without resistance (try and move £1bn of anything (cash, gold, cars) to a different country.

Bitcoin does it easily and cheaply because it exists on its own network outside the traditional financial system. It does not rely on the banks.

It has no technical counter party risk if there is contagion default in the credit market. It stands alone in its own proof of work monetary system.

Greg Foss argues Bitcoin is default insurance on Sovereign nations and Fiat Currencies. Foss perfectly sums this up in his paper:

In a debt/GDP spiral, the Fiat currency is the error term. All Fiats are melting ice cubes. The rate of decay is relative, but all Fiats melt. It is only math. - Foss

The full paper can be downloaded here (pdf).

Is Buying Bitcoin a Bank Run?

As more people buy bitcoin with their pounds/dollars/euros etc the price goes up. Buyers are continuing to sell fiat for bitcoin despite its price volatility. We would argue that the purchase of bitcoin is a run on all fiat currencies.

Unfortunately this is what happens when you replace a currency based on something with a currency based on nothing:

The Wealth Gap View : GET OFF ZERO! (how much is up to you). As per usual this is not financial advice but we would suggest getting some exposure to Bitcoin. It’s hard to keep the gloom out of a warning piece like this but you have to believe we are optimistic about the future. Societies routinely go through periods of uncertainty and come out the other side. There will always be winners and losers during periods of extreme change and we want out friends to be winners.

Until Next Time

The Wealth Gap Team

Great thread 👍🏻