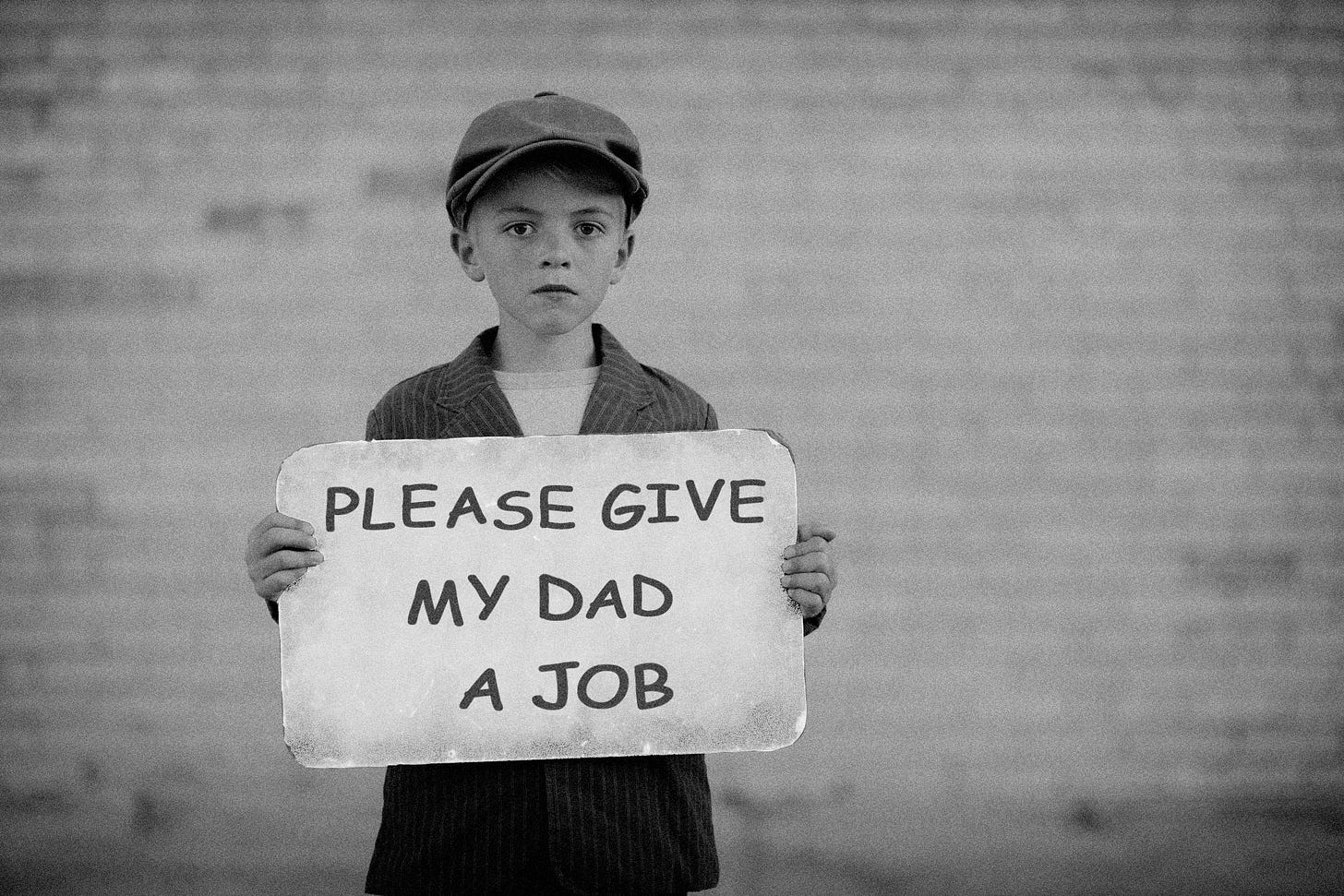

The System is Broken (Deflation Could Be a Good Thing)

Why technology replacing jobs is actually awesome!

In this article we will look at the different types of deflation and the pro’s & cons of it in our current financial system. If you’ve spent anytime researching deflation you will find nobody does it better than Jeff Booth so naturally we’ve based a lot this article on his work.

What is Deflation?

Investopedia describes the definition of deflation as follows:

Deflation is a general decline in prices for goods and services, typically associated with a contraction in the supply of money and credit in the economy. During deflation, the purchasing power of currency rises over time.

So prices fall (good) but for bad reasons…? We don’t know whether we should feel guilty about wanting prices to fall or not after reading this definition. It’s a bit like being given a new bike by your Nan but finding out she didn’t eat for a week to pay for it 😔

As with all things in the financial world there is a big cyclical circle jerk going on…

If prices start dropping you the customer will initially be cheering (cheap stuff yay!) until you lose your job because the company you work for can’t make enough money on its products to keep you employed.

If you lose your job you might default on your bank loans/mortgage. If everyone is in the same position as you then banks enter a crisis and the whole economy shudders.

There are Different Types of Deflation

Supply/Demand (prices go down as supply is greater than demand)

Technology Deflation (technology makes production cheaper/faster/better over time)

Debt Deflation: When prices and wages fall while debts and interest payments are fixed, then borrowers face increasing pressure on their ability to repay what they have borrowed. Normally we like fixing the interest rates on our debts (provides long term peace of mind), but a debt deflation environment could get ugly if your stuck paying a fixed rate on your debt while your income falls.

Technology Deflation is Different… and Inevitable

Picture, if you will, the process of digging a trench. By hand it will take a LOT of workers a LONG time to complete. The invention of the shovel, followed by the Digger made it possible to dig bigger holes in less time for less cost.

The Benefits:

More can be achieved

More can be done quicker

More can be done cheaper

The Drawbacks

1 worker with a digger can outpeform 100 workers with shovels. Those 99 shovellers need to find another way to make a living

We all know technology replaces jobs and we have been programmed to see that as a bad thing. However every technological leap has been accompanied with new industries for workers to join.

Technology Deflation Can be a Force for Good

Take a moment to appreciate your phone. This marvellous bit of technology allows you you to contact anyone in the world, monitor your health, make purchases, sell things and provide entertainment. It is a marvel of ingenuity and has become this wonder in a very short period of time.

One should also note however that many industries creating independent standalone products were destroyed by this innovation and absorbed by the technology. When was the last time you bought a physical Map, Compass, Calendar, Alarm…etc?

We don’t need an Inflationary Economic Model

Not even going to try and rephrase what Jeff said..

Jeff’s twitter thread below nails it so succinctly we thought it best to just post it

An inflationary environment that was manufactured by central banks - and once they were caught in it, they didn't see a way out. So, instead of facing new facts - That technology brings efficiency and allows prices to fall, they "doubled down" on inflation.

We are now part of a system that requires ever more inflation, jobs and higher taxes to pay for a "black hole" of debt that can never be paid back. Unable to reach escape velocity from the "debt gravity" Central banks actual fuel the thing they fear most. "deflation".

Debt itself is deflationary because of taxes that need to go up in the future to pay for demand that was pulled forward through debt. And higher taxes - means less jobs. The following is a snapshot of what is happening.

Need inflation - Drive growth at all costs > Lower interest rates > debt binge (pulling demand forward) > distort rules of capitalism when debt can't be repaid by bail outs and CB intervention concentrating wealth in hands of very few > leading to massive inequality/social unrest

While technology advances and takes jobs anyways > leading to extreme political views > leading to divisive leaders > with cycle repeating until currency crisis's, revolutions and wars with 99% of the people blissfully unaware of what caused it all in the first place.

A structural change where an inflationary monetary policy cannot work because the technology today is so powerful in bringing down prices. - and it has only just started - most of the deflation is in front of us.

So we are ALL caught in a system where we cannot see why deflation might be a fantastic thing. Deflation = value of your money going up in relation to goods and services. And doesn't that mean that we could step off the insanity of a broken system.

In his book (The Price of Tomorrow), Jeff Booth discusses the benefits of deflation.

In his book Jeff Booth states :

Technology is deflationary. That is not conjecture. It is the nature of technology. And because technology underpins more and more of the world around us, it means that we are entering into an age of deflation unlike any the world has ever seen.

This maybe at odds with what we are currently experiencing with inflation (2021) but that is due to the existing financial framework being inflationary by design and the money printer going berserk globally to cope with ever increasing inflationary demands and borrowing.

“In 2000, the total debt in the world was approximately US $ 62 trillion. At the same time, the world economy in 2000 was about US $ 33.5 trillion. Since 2000, the world economy has grown from US $ 33.5 trillion to about US $ 80 trillion, but to achieve that growth, the total debt has grown to over US $ 247 trillion as of the third quarter of 2018, according to the Institute of International Finance. In other words, it has taken approximately $ 185 trillion of global debt to achieve $ 46 trillion of global growth…. The mirage of growth today is nothing more than a debt-fuelled spending binge.”

The existing financial system (forever printing money) is now butting heads with technology and there will be only one winner! Jeff Booth sits fully in the camp that technology will continue to create increasing deflation as goods and services will become less scarce and maybe even free in some cases (we agree).

Embracing technology and getting out of the way of its exponential growth has many benefits and will make so many things more affordable but to get out the way we are going to have to consider/accept huge changes in the way existing systems are structured and incentivised.

The biggest issue (socially) that arrises from this tech revolution will be Jobs! There seems to be a running sentiment that “new tech creates new jobs” but that is only true in so far as to build out the infrastructure for the modern age. Once these pieces are in place then “work” will get rapidly assimilated by technology. We are already seeing the rise of robotics in the workplace (Amazon, Tesla etc) and that trend will only continue.

Computers & Robots do not need wages, days off or lunch breaks 🤖

Until Next Time

The Wealth Gap Team